Overview

GSPL is a government company engaged in the business of transmission of Natural Gas through implementation & commissioning of pipeline network to mostly Gujarat and other North Western states. It operates 18% of the total LNG pipeline network in India. It is a network or transmission type of business- it profits by connecting the supply points with the demand. Besides pipelines, since last year the company has also ventured into using trucks as a mode of transmission. The company has a few subsidiaries and JVs in companies like GIGL, GITL, Gujarat Gas, and Sabarmati Gas, all of them contributing to the gas transmission revenue. (Most notably Gujarat Gas Ltd contributing to 24% of the revenue via the last mile of city gas distribution to customer)

The company does not purchase any gas - it operates on an open access basis which means that the customer is free to choose the supplier and purchase gas, the company profits only from the transmission/ distribution of this gas not the sale and purchase itself.

Besides gas transmission, the company also owns and operates a 52.5 MW Wind Power Project in Gujarat State.

Segment Revenue:

Gas Transmission- over 98%

Sale of Electricity- less than 2%

The mode of revenue for the company is by entering into Gas Transmission Agreements or GTA’s. These can be short term (few months) to long term (many years). Regardless of the amount of gas transmitted, the company collects tariffs from customers. These agreements are only renewed or canceled when expired, so it provides a stable revenue source till the agreement expires.

Economic Advantage

Transmission & Distribution companies have a wide economic moat, since they’re mostly monopolies in their areas of operation. Regulation, infrastructure & network barriers protects big companies in this industry from competition threat.

The company has a monopoly over gas transmission in Gujarat, and is the 2nd largest pipeline network in India after GAIL. For laying gas pipelines, a bidding process has to be followed. Therefore, being a highly regulated & infrastructure dependent business, the threat from new competition isn’t strong.

Gujarat is the biggest domestic gas consumer in India, accounting for over 40% of domestic gas consumption. So the revenue from existing infrastructure in Gujarat is likely to continue in the short-medium term.

Growth Potential (How can the company grow?)

LNG is the cleanest fossil fuel, with much less emissions than coal and oil. India is expected to move towards lower emissions in the future and LNG is expected to increase its share in the energy sources in future. Currently it only contributes about 7% to total demand.

Gas use is expected to rise in Industrials and city segments, in line with the 2070 net zero target set by India at COP 26 Glasgow summit. The Ministry of Petroleum and Natural Gas is aiming toward a 15% share of Natural Gas in India’s total energy mix by 2030.

The company is expanding its grid to include other states over the next 5 years, this capex is largely funded without debt only by internal accruals.

Two large projects are underway with its two JVs - GIGL and GITL for constructing about 3600 kms of gas pipelines. These are capital consuming projects with a 70:30 debt funding.

Overall, the company has seen a revenue growth of 22% CAGR since 2017.

Profitability

GSPL being a transmission business, generates excellent margins (70%+) & low growth (4-5%). This is coupled with the gas distribution business (the last leg of the supply chain to the consumer) which has great growth (20-25%) with not-so-great margins (6-7%). Overall the EPS growth has been a stable 12% with FY21 being the only declining year since 2016 (Industry slowdown causes lower demand in natural gas- fertilizers & petroleum being the major industrial consumers)

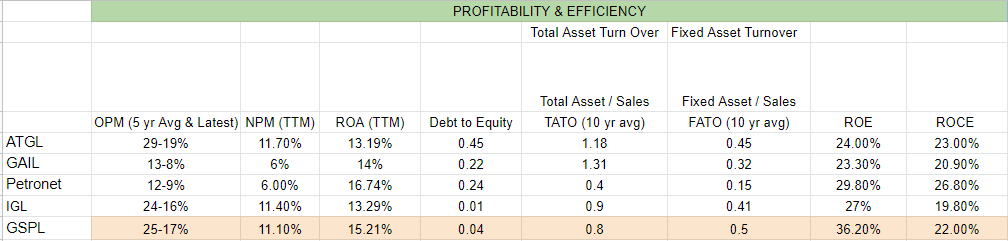

When compared with the gas transmission & distribution industry, the company generates best ROE and ROCE (20%+), while also generating the best returns on assets (15%+), nearly the best Fixed and Total Asset Turnovers (1.25x - 2x) and also almost highest operating margins (17-25%) and net margins (11.10%). Industry efficiency comparison looks something like this:

Financial Health

The company has a very low level of debt, also almost the lowest debt to eq. in the industry. Recently they have also paid off a lot of the debt, 2000 Cr in FY 21 to 350 Cr presently. The interest coverage is strong at 34 times so there is sufficient liquidity.

However, large debt funded capex are underway with its JV’s so we have to keep an eye on that.

Red Flags and Bear Case

Sudden spike in LNG prices sends the demand lower and may cause a decline in revenue growth. This was observed in FY21. In FY22 also, LNG demand has shown decline due to price peaking because of political tensions.

Debt increasing due to capex plans would be a cause for concern as increased interest means further margin pressure.

Valuation

Comparing to the industry

When comparing with the Gas Transmission & Distribution Industry, the company is very cheaply valued whether you look at it from a Price to Earning, Price to Sales or even Price to Growth or Price to FCF ratios. The comparison looks something like this:

Historical Relative Valuation

When comparing with itself over the last 5 years, the company is trading at a PE of 9, which is slightly below average. It has a P/Book value of 1.7, which 1is almost the lowest it has been, and a price to sales of 0.7 which is also near lowest levels. The EV/EBITA is at 3.9 which is again, trading at near lows. Overall it is clear that we’re not paying any relative premium.

DCF Valuation

Discounting cash flows by 12% for a fairly stable company in a slightly fluctuating industry, our DCF calculations gives us an intrinsic value of 385-432. Putting a 20% margin of safety from this still nets us 308 which is 16% higher than CMP (265). This gives us a pretty good discount of 36-60%

2Yr Earning & Dividend Growth (Non Speculative, if PE does not change)

If the PE stays constant, we can expect the price to reach 330 + just from earnings growth in the next 2 years. Which is a decent 24% total return and a 11.5% CAGR. Not bad compared to the index.

My investment

I have invested in this company since 234 levels, and I expect a 20-35% return on my investment. It looks like a good, stable cash generator with a decent future outlook.

Research source: screener.in, annual report FY22, credit rating report (Care Ratings). Do your own due diligence, this isn’t financial advice or recommendation.