Overview

Coromandel is one of India’s largest agri input manufacturers. The company serves the agricultural industry mainly via 2 segments - Nutrient (Phosphate based fertilizers, organic fertilizers & specialized nutrients) and Crop Protection (Chemicals & Neem based pesticides). Their products are distributed across India using their retail chain with 750+ stores. Besides being a one stop shop for their products, these retail stores provide services such as soil testing, crop diagnostics, and farm mechanization services.

The competition is stiff in the agro industry. Despite being India’s leading Single Super Phosphate (SSP) fertilizer player, the market share of the company is only roughly 16% in the fertilizers segment. This means that the economic advantage in fertilizers is only partially based on products & more from how well you can reach the farmers with your products. In this aspect the company is well networked in India with ~20000 dealers besides their own retail stores & their products are sold in ~80 countries. The company has a market development team of 2000 persons. They have 16 manufacturing plants mostly in south and west India.

Revenue from segments (approx. figures):

Nutrients & Allied: Around 90%

Crop Protection: Around 10%

Geographical distribution of revenue (approx. figures):

37% from exports.

63% domestic

Misc. notes:

Coromandel International is part of Murugappa Group and a subsidiary of EID Parry, which holds 62.82% of the equity in the company. It has around 12 subsidiaries of its own.

Non exec. & exec directors are compensated an incentive based on the net profits (under 1% of NP).

Growth Potential

India is lagging behind by a lot in terms of crop protection consumption, being as low as 0.6 kg/ Hectare compared to other countries (UK = 5 kg/ha, US = 7 kg/ha & China = 13 kg/ha). This is also apparent by the growth in the company’s crop protection segment (20% in FY22). The recent ban on pesticides (which included 3 of the company’s products) apparently hasn’t had any effect since the company keeps introducing new products in this segment.

The nutrient & fertilizer segment has also shown a revenue growth of 14% CAGR since 2018. I expect this growth to continue at above 10% or above till 2027. Since fertilizers is such an important commodity in India, the government also increases the subsidy in case the raw material prices have a sudden surge (as witnessed in FY 22-23).

Profitability

The raw material required for production of Phosphate based fertilizers is Phosphoric Acid & Sulphuric Acid. The company has secured its PA supply using a subsidiary (Tunisian Indian Ferts which supplies 70%, the rest is purchased from the market This subsidiary provides 50% output to CIL).

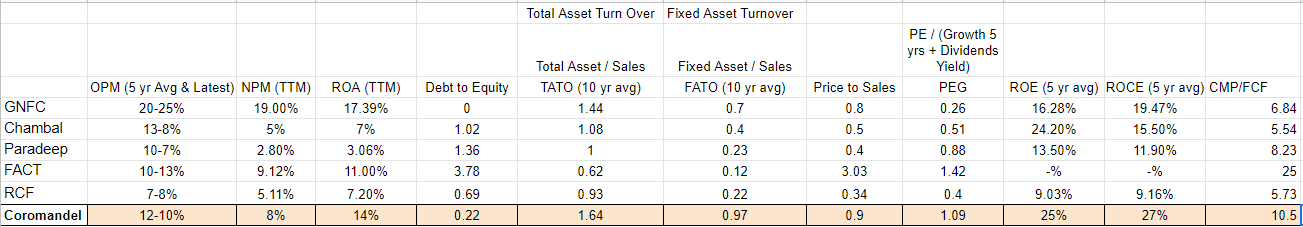

The company still has maintained an OPM of 12% over the last 5 years, recently dipping to 10%. The TTM NPM is around 8% which is inline or better than most competitors. These numbers may look low but they’re still better than most competitors and they’re offset by a high Total Asset Turnover of 1.64, higher than most competitors. The company also generates the best fixed asset turnover in the industry at 0.97 as well as a better return on assets than most competitors. This basically means that this is a low margin but high volume business. The company also generates a healthy level of free cash flows. The company also generates best ROE and ROCE in the industry.

Industry comparison looks something like this:

Financial Health

The company is in no financial risk with high interest coverage (18x) and low levels of debt, despite having ongoing capex projects (debottlenecking raw material production).

Bear Cases

A sudden spike in raw material prices could cause margins to lower to levels where EPS is majorly affected.

Government action and ban on pesticides can influence revenue growth in this segment (although the previous ban didn’t appear to affect any revenue)

Losing market share to competitors (from the current 16% in SSP segment) will majorly affect their dominating segment.

Valuations

From a relative perspective, the company is currently trading at a 5 year lowest PE ratio of 12. P/B ratio is also at near 5Y lowest levels (3.5 currently- lowest 3). Price to Sales ratio is also at near 5Y lowest (current 0.9- lowest 0.8). With respect to growth, at currently price you’re paying a PE/G ratio of 1.09 which is not a discount but also not a premium.

Using discounted cash flows to value this company while assuming that the perpetual growth rate is 4% (similar to projected Indian agriculture industry growth rate till 2027). Since the company hasn’t shown any significant revenue decline in the last 10 years, I’m using an 10.5% discount (the industry is still cyclical). This gives us a per share value of roughly 1075. The stock is currently trading at 874 which gives us a margin of safety/ discount of 20% from intrinsic value.

2Yr Earning & Dividend Growth (Non Speculative, if PE does not change)

If the PE of this stock does not change over the next 2 years, then we should expect the price of this stock to reach 1075 at current EPS growth levels. This gives us a return of 24% or 11.3% CAGR which is pretty decent.

My Investment

I’m buying this stock at current levels (874) and will continue to buy on dips. The technical trend is bearish so I’m expecting this fall to continue for a little bit.1

Research sources: screener.in, annual reports, conference calls & credit rating report from India Ratings. Disclaimer: I will benefit from price appreciation of this company, do your own due diligence.